|

Please click on the topic to access to information and training*

ROLES AND RESPONSIBILITY* Please Click on "+" sign to expand and "-" sign to collapse the topic.

Body corporate legislation

Most bodies corporate are a community titles scheme registered under the Body Corporate and Community Management Act 1997 (the BCCM Act). In addition to the BCCM Act, each scheme is registered under one of five regulation modules. There are also regulations that apply to all bodies corporate. For a full copy of the BCCM Act and the regulations see:

ROLE OF THE BODY CORPORATE

The role of a body corporate in Queensland is to administer common property and body corporate assets for the benefit of all of the owners, and to undertake functions required under body corporate legislation. What is a body corporate? A body corporate is a legal entity which is created when land is subdivided and registered under the Land Title Act 1994 (PDF) to establish a community titles scheme. All of the owners in a community titles scheme are automatically members of the body corporate when they buy their lot. Community titles scheme Community titles schemes allow you to privately own an area of land or part of a building, as well as share common property and facilities with other owners and occupiers. A community titles scheme is made up of 2 or more lots, so it could be a:

What a body corporate does? The body corporate is given powers under the legislation to carry out its necessary duties. The body corporate:

BODY CORPORATE MANAGER

A body corporate can engage a body corporate manager to supply administrative services to the body corporate. At present body corporate managers are not required to be licensed in Queensland. There are no formal training requirements or qualifications needed to be a body corporate manager. When a body corporate manager is needed There is no legal obligation for a body corporate to have a manager. A body corporate may choose to engage a manager when:

Duties of a body corporate manager The duties of a body corporate manager can differ depending on whether the body corporate has a committee or not. In a body corporate with a committee If a body corporate has chosen a committee, the body corporate manager is engaged to help the committee. The manager can only do what the body corporate asks them to. The duties of the manager are contained in the written engagement entered into with the body corporate. A manager automatically becomes a non-voting member of the body corporate committee. The voting members of the committee can ask a manager not to attend a committee meeting. Maintenance of common property The manager is not responsible for the maintenance of the common property, but may organise work if the committee asks them to. Exercising the executive committee member powers Usually the manager is authorised to perform the duties of secretary and treasurer including:

In a body corporate with no committee A body corporate manager engaged when there is no committee is authorised to carry out all the functions of a committee and to exercise all committee powers. The body corporate manager makes the decisions that a committee would usually make. See sections 58 to 62 of the Body Corporate and Community Management (Standard Module) Regulation 2008 (PDF) (and equivalent sections in other regulation modules) for more information on the responsibilities of a manager during and at the end of a contract. Managing administrative and sinking funds A manager operating in a body corporate with or without a committee can be asked to manage funds. When a manager is authorised to look after the body corporate’s administrative and sinking funds, the manager must:

The body corporate manager must comply with the code of conduct for body corporate managers and caretaking service contractors when performing under their engagement. The code of conduct is automatically included in the terms of their engagement. If there is a difference between the code of conduct and the manager’s engagement, then you should always refer to the code of conduct. Under the code of conduct, a body corporate manager must:

When there is a committee The committee does not have the power to engage a body corporate manager. The body corporate must pass a motion at a general meeting by ordinary resolution to engage a body corporate manager under a contract. The terms of the contract must be included in the documents sent to members of the body corporate before the general meeting takes place. The written engagement must list:

If a body corporate is unable to elect a committee, it can pass a motion at a general meeting to engage a manager. The body corporate can hold an extraordinary general meeting if at the annual general meeting the body corporate:

The notice for the extraordinary general meeting must include the terms of the contract and an explanatory note. The explanatory note must outline:

The engagement must:

How to terminate a body corporate manager A manager’s engagement can be ended if they:

Failing to perform or comply To end a manager’s engagement for failing to perform duties, comply with the Act or code of conduct, the body corporate must issue a remedial action notice. This decision can be made by the committee of the body corporate. The remedial action notice must state:

Serving a remedial action notice when there is no committee If the body corporate wants to terminate a manager’s engagement when there is no committee, the decision to serve the remedial action notice can by made by the owners of a least one half of the lots included in the scheme. Role of the committee

A body corporate must elect a committee at each annual general meeting. The committee is made up of lot owners or people who act for them. The committee is in charge of:

Committee members The following information applies to schemes under the:

If the community titles scheme has more than 7 lots, the maximum number of committee members is 7. If a community titles scheme has less than 7 lots, the maximum number of committee members is the same as the number of lots. This is called the ‘required number of committee members’. The committee will usually include a chairperson, secretary and treasurer (known as the executive). One person may hold all or any two executive positions. For schemes under the Small Schemes Module, the committee consists of a maximum of 2 members. The committee will only include a secretary and treasurer. One person may hold the positions of secretary and treasurer at the same time. For schemes under the Specified Two-lot Schemes Module there is no committee. Find out further information about forming a body corporate committee in Meetings section. The chairperson The chairperson must chair all general meetings and committee meetings which they attend. If the chairperson is not at a meeting, the voters who are there can choose another person to chair the meeting. When chairing a general meeting, the chairperson’s duties include:

The chairperson does not have any more authority than anyone else on the committee. The secretary The secretary's duties include:

If the body corporate has engaged a body corporate manager, it may authorise the body corporate manager to carry out the secretary's duties. The treasurer The treasurer’s duties under the legislation are limited. If there is no body corporate manager, the committee may ask the treasurer to create a reconciliation statement. If the body corporate passes an ordinary resolution at a general meeting, a statement must be prepared, within 21 days after the last day of each month, for each account kept for the administrative and sinking fund, showing the reconciliation of:

If the body corporate has engaged a body corporate manager, it may authorise the body corporate manager to carry out the treasurer’s duties. Non-voting members of the committee If the body corporate engages a body corporate manager or a caretaking service contractor, they are automatically non-voting members of the committee. A non-voting member does not have a right to vote on a committee decision. Restrictions that apply to committee decisions The committee cannot make a decision about:

Committee spending limit Committee spending is limited and money must be available in the budget before the committee can spend it. If there is not enough money in the funds the committee would have to think about calling a general meeting to amend the budget or to raise a special levy. Service contractor/ROLE OF A SERVICE CONTRACTOR AND LETTING AGENT

A body corporate may engage

These people perform specific duties to help a body corporate meet its legal obligations. What is a service contractor? The information in this section applies to schemes registered under the all the regulation modules. Where there is any differences between the regulation modules this will be specifically identified. Service contractors supply services for the benefit of the common property or the lots included in the scheme. A service contractor is someone engaged by a body corporate for at least 1 year to supply services other than administrative services. See section 15 of the Body Corporate and Community Management Act 1997(PDF) for the definition of a service contractor. The services they provide can include but are not limited to:

Body corporate managers are not service contractors. Body corporate managers are contracted by the body corporate to supply administrative services. What is a caretaking service contractor? Schemes that are registered under the Small schemes Module and the Specified two lot Module are not able to engage a caretaking service contractor. A caretaking service contractor is a service contractor for a community titles scheme who can also be authorised as a letting agent for the scheme (or an associate of a letting agent for a scheme.) See section 16 of the Body Corporate and Community Management Act 1997(PDF) for the definition of a letting agent. If they own their lot they are able to vote at general meetings. They are automatically a non-voting member of the committee but are ineligible to be a voting member. The person is often referred to as having the ‘management rights’ and can be known under different names such as the caretaker, building manager, onsite manager or resident manager. What is an authorised letting agent? Schemes that are registered under the Small Schemes Module and the Specified Two Lot Module are not able to authorise a letting agent for the scheme. A letting agent is authorised by the body corporate to let lots and collect rents for investor owners. They must be licensed under the Property Occupations (PDF) Act 2014 . Check licence requirements with the Office of Fair Trading Generally a caretaking service contractor is also authorised to be the letting agent for the scheme and owns or leases a lot and runs the letting agent business from that lot There is no need for a letting agent to give the body corporate details of the letting arrangements. However, they may have to give the body corporate some information on lots for the body corporate roll. Owners do not have to use the authorised letting agent to let their lots. Owners may choose to let their lots privately or use a real estate agent. Codes of conduct A caretaking service contractor must comply with the code of conduct for body corporate managers and caretaking service contractors as well as the code of conduct for letting agents. See the Body Corporate and Community Management Act 1997 (PDF) The code of conduct is automatically included in the terms of their engagement. If there is a difference between the code of conduct and their engagement, then you should always refer to the code of conduct. Under the code a caretaking service contractor must:

SERVICE CONTRACTOR/ENGAGING A SERVICE CONTRACTORSERVICE CONTRACTOR

The information on this page applies to schemes registered under all the regulation modules. Where there are any differences between the regulation modules, this is specifically identified. Service contractors and caretaking service contractors are engaged by the body corporate. The caretaking service contractor is also authorised to conduct a letting agent business for the scheme. Service contractors and caretaking service contractors are not employees. The original owner (developer) may initially engage a service contractor (or authorise a letting agent). The developer sets the initial salary, which should relate to the work done. If the developer does not engage any service contractors, or the original term of engagement expires, the body corporate may decide on a new engagement by ordinary resolution at a general meeting. The body corporate cannot sell the letting or caretaking rights. The general meeting notice where a new engagement (for a service contractor) or authorisation (for a letting agent) is voted on must include the terms of the contract as well as any options of extension or renewal. The new engagement or authorisation must:

Schemes registered under the Small Schemes Module or the Specified Two-Lot Schemes Module cannot engage caretaking service contractors or authorise a letting agent for the scheme. They can only engage service contractors. Terms of engagements The minimum term of engagement of a service contractor is 1 year. The maximum term of engagement of a service contractor and a caretaker service contractor depends on the regulation module applying to the scheme. The Standard Module allows for a maximum term of 10 years. The Accommodation Module and the Commercial Module allow for a maximum term of 25 years. Schemes registered under the Small Schemes or Specified Two-Lot Scheme modules can only engage a service contractor for a maximum term of 1 year. The term of engagement includes any rights or options to extend or renew the contract — whether provided for in the first engagement or agreed to later. SERVICE CONTRACTOR/AMENDING AN ENGAGEMENT

The information on this page is for body corporate schemes registered under the:

For a caretaking service contractor the motion to amend the engagement must be decided by secret ballot. No votes can be cast by proxy. A motion to amend a service contractor engagement can be decided by open ballot and no votes can be cast by proxy. The general meeting notice must include an explanatory note (in the approved form) explaining the amendment. The amendment must:

For schemes registered under the Two-lot Schemes Module, an amendment can be made by lot owner agreement. SERVICE CONTRACTOR/TRANSFERRING AN ENGAGEMENT

This information is for body corporates schemes registered under the:

A person’s right under an engagement as a service contractor, or under an authorisation as a letting agent, may be transferred. If they have body corporate approval, a service contractor can sell their business. A transfer can be approved by a resolution of the committee. Find out how the committee makes decision at a committee meeting or by vote outside a committee meeting. The committee can consider the following:

The committee cannot unreasonably withhold approval. The committee can ask to be reimbursed for reasonable costs incurred during the approval process. The committee cannot receive or ask for any other fee or reward for considering the transfer. Transfer fee If the engagement is transferred within 2 years of the initial contract date, the person transferring their business may be asked to pay a fee. The transfer fee will be either:

SERVICE CONTRACTOR/TERMINATING AN ENGAGEMENT

This information applies to schemes registered under all the regulation modules. Any differences between the regulation modules will be specifically identified. Note: body corporate schemes registered under the Small Schemes Module and the Specified Two-lot scheme Module can only engage a service contractor not a caretaking service contractor. An engagement of a service contractor or a caretaking service contractor or an authorisation as a letting agent can be terminated:

Terminating by agreement The body corporate can terminate a person’s engagement as a service contractor or authorisation as a letting agent if:

Terminating for conviction of offences The body corporate can terminate a person’s engagement as a service contractor or authorisation as a letting agent if the person (or director if it is a company):

Remedial action notice The body corporate can terminate an engagement of a service contractor or authorisation of a letting agent for:

The remedial action notice must state:

If the engagement is terminated, the service contractor and/or letting agent is unable to transfer their business to someone else. Transferring the engagement Instead of terminating an engagement or authorisation the body corporate may make the service contractor and/or letting agent transfer it (i.e. sell it to someone else with approval of the body corporate). They may be able to leave the scheme with some financial return if the engagement is transferred. Read more about transferring an engagement —the process leading up to the transfer or termination of an engagement is complex. Note: The body corporate should consider getting private legal advice before it seeks to enter into, terminate, amend or transfer a legal contract. Resolving disputes The Office of the Commissioner for Body Corporate and Community Management has limited jurisdiction to resolve disputes involving service contractors and caretaking service contractors. The legislation only recognises these disputes as between the body corporate and the contractor. A lot owner cannot lodge a dispute resolution application against a service contractor or a caretaking service contractor. Disputes that are about a contractual matter relating to an engagement, the transfer of the engagement or the review of terms of an engagement are defined as complex disputes. Complex disputes may be determined by the Queensland Civil and Administrative Tribunal or by a specialist adjudicator appointed by the Commissioner. Specialist adjudication An application for specialist adjudication must nominate someone to act as a specialist adjudicator. A specialist adjudicator can only be appointed if all parties to the dispute agree in writing on:

BODY CORPORATE LEGISLATION DEFINITIONS

This content is a list of terms used in the Body Corporate and Community Management Act 1997 (PDF), and definitions of their meanings. This is not meant to be a list of all body corporate related terms. For more body corporate definitions see the dictionary section of Schedule 6 of the Act. Adjustment order For contribution schedule lot entitlements, an adjustment order is an order of a court, tribunal or specialist adjudicator, made before 14 April 2011, providing for an adjustment of the contribution schedule for an existing scheme. An adjustment order does not include an order of a court or tribunal giving effect to a decision that is not made by the court or tribunal or another court or tribunal (including a decision that is not, but is taken to have been, made by a court or tribunal). For example:

Body corporate asset Any real or personal property acquired by the body corporate, other than property that is incorporated into and becomes part of the common property. Body corporate assets may be any property an individual is capable of acquiring. For example:

Common property Freehold land forming part of the community titles scheme land but not forming part of a lot included in the scheme. Complex dispute A complex dispute is a dispute that can only be decided by a specialist adjudicator or the Queensland Civil and Administrative Tribunal in its original jurisdiction—or the appeal of a decision of a specialist adjudicator or the Queensland Civil and Administrative Tribunal. Complex disputes include:

Community management statement A community management statement is a document registered with Registrar of Titles that sets out the identification of a community titles scheme. The community management statement identifies matters such as the:

Community titles scheme A community titles scheme is scheme land and the single community management statement identified with the Registrar of Titles identifying that scheme land. A community titles scheme comprises:

Contractors Body corporate manager A body corporate manageris a person or entity engaged by a body corporate (other than as an employee of the body corporate) to supply administrative services to the body corporate. A body corporate manager may or may not be engaged to carry out the functions of a committee, and the executive members of a committee, for a body corporate. Caretaking service contractor A caretaking service contractor is a service contractor for a scheme who is also a letting agent for the scheme, or an associate of the letting agent. Service contractor A service contractor is a person or entity engaged by the body corporate (other than as an employee of the body corporate) for a term of at least 1 year to supply services (other than administrative services) to the body corporate for the benefit of the common property or lots included in the scheme. Services that a service contractor might provide include:

Debt disputes Debt dispute A debt dispute is a dispute between a body corporate and a lot owner in the scheme about the recovery, by the body corporate from the owner, of a debt under this Act. Related debt dispute A dispute is a related disputeto a debt dispute if:

General meeting resolutions Majority resolution A motion is passed by majority resolution if the votes counted for the motion are more than 50% of the lots for which persons are entitled to vote on the motion. For a motion to be decided by majority resolution, only 1 vote may be exercised for each lot in the scheme. The vote must be written and cannot be exercised by proxy. Ordinary resolution if no poll requested A motion is passed by ordinary resolution, if no poll is requested, if the votes counted for the motion are more than the votes counted against the motion. Only 1 vote may be exercised for each lot included in the scheme, whether personally, by proxy or in writing. Ordinary resolution if poll requested-- A motion is passed, if the total of the contribution schedule lot entitlements for the lots—for which votes are counted for the motion— is more than the total of the contribution schedule lot entitlements for the lots—for which votes are counted against the motion. Only 1 vote may be exercised for each lot included in the scheme, whether personally, by proxy or in writing. Requesting a poll voteA person entitled to vote at a general meeting may ask for a poll on a motion to be decided by ordinary resolution, other than an ordinary resolution conducted by secret ballot. The person must ask for the poll before the meeting decides the next motion on the agenda or, for the last motion on the agenda, before the end of the meeting. The person must ask for the poll either:

Resolution without dissent A motion is passed by resolution without dissent if no vote is counted against the motion. Only 1 vote may be exercised for each lot included in the scheme, whether personally, by proxy or in writing. Special resolution Only 1 vote may be exercised for each lot included in the scheme, whether personally, by proxy or in writing. A motion is passed by special resolution if:

Improvements For the purposes of improvements to common property, animprovementincludes:

Interested persons Access to body corporate records An interested person means:

Inspections of applications and submissions An interested person, for an application, means:

Layered schemes Layered arrangement of community titles schemes A layered arrangement is a grouping of community titles schemes in which there is 1 scheme (principal scheme) which is not a lot in another community titles scheme and which is made up of:

Principal scheme A community titles scheme which has 1 or more lots which are a community titles scheme, and which is not a lot within another community titles scheme. Subsidiary scheme A community titles scheme which is a lot in another community titles scheme (the principal scheme). A subsidiary scheme may be a lot included in the principal scheme or may be a subsidiary scheme for another community titles scheme that forms part of the layered arrangement. Basic scheme A community titles scheme which has no lots which are a community titles scheme. Number of layered lots For a principal scheme in a layered arrangement of community titles schemes, the number of layered lots is the total of the:

Lot entitlements Contribution schedule lot entitlements The contribution schedule is a schedule recorded in the community management statement that lists each lot’s contribution schedule lot entitlement. The contribution schedule lot entitlement for a lot is the basis for calculating the:

Interest schedule lot entitlements The interest schedule is a schedule recorded in the community management statement that lists each lot’s interest schedule lot entitlement. The interest schedule lot entitlement for a lot is the basis for calculating the:

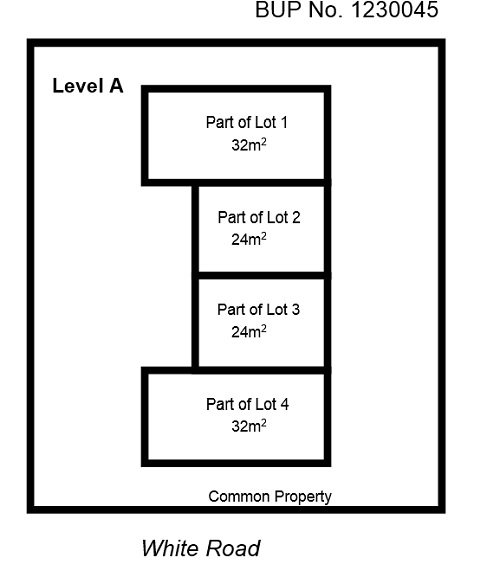

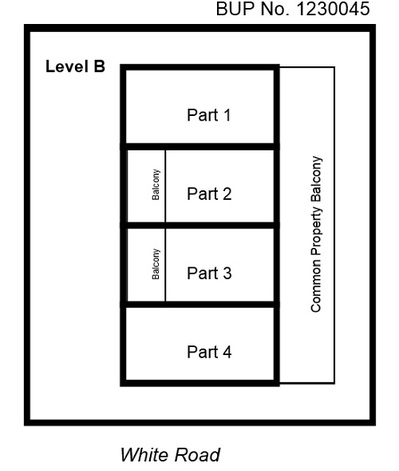

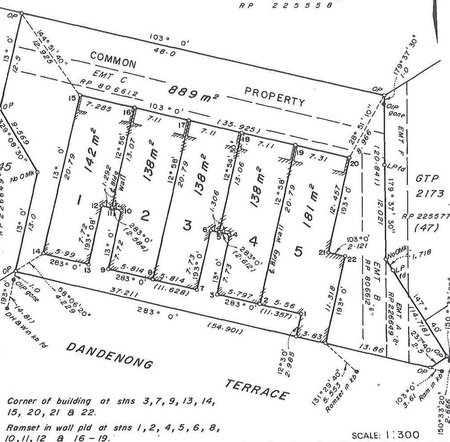

Plans of subdivision Building format plan A building format plan of survey defines land using the structural elements of a building. For example:

Standard format plan A standard format plan of survey defines land using a horizontal plane and references to marks (such as posts) on the ground (see section 48B of the Land titles Act 1994). Specified two-lot schemes The following terms apply only in a scheme regulated under the Specified Two-lot Schemes Module. Contributing owner The owner of a lot who pays a contribution payable for their lot by the date for payment. Defaulting owner An owner of a lot who does not pay a contribution payable for their lot by the date for payment Lot owner agreement An agreement between the owners of the lots, or their representatives. BODY CORPORATE REGULATION DEFINITIONS

This content is a list of terms used in body corporate regulation modules, and definitions of their meanings. This is not meant to be a list of all body corporate related terms. For more body corporate definitions see the dictionary section of each regulation module schedule. Abstain When a voter chooses not to cast a vote on a motion, either for or against it. No vote is counted for an abstention. Address for service The address which body corporate notices must be sent to. The address for service for a lot owner, and any other person whose address for service needs to be given to the body corporate, is recorded on the body corporate roll. Even if there are 2 or more co-owners for 1 lot, there must be only 1 address for service for a lot. Standard module The address for service in a standard module must be an Australian address. However, if the body corporate hasn’t been notified of an address, the address for service is the residential or business address that the body corporate was last notified of for the lot owner or another person (whether in or out of Australia). Accommodation, Commercial, Small Schemes and Specified Two-lot modules If no address for service has been notified to the body corporate in an accommodation, commercial, small schemes or specified two-lot scheme module, the address for service is the residential or business address that the body corporate was last notified of for the lot owner or another person (whether in or out of Australia). Body corporate debt Any of the following owed by an owner of a lot to the body corporate:

Committee members Non-voting member of the committee The body corporate manager and caretaking service contractor for the community titles scheme are automatically non-voting members of the committee, without further election or appointment, even if they are also lot owners. Non-voting members of the committee are not entitled to vote at committee meetings. Voting member of the committee An eligible person who is appointed to the committee by the body corporate. A voting member is able to vote at committee meetings. They do not include non-voting members of the committee. Corporate owner A corporation that is the owner of the lot. This does not include a body corporate for another community titles scheme that comprises a lot included in the scheme, in its capacity as the body corporate for a subsidiary scheme for the scheme. Corporate owner nominee The person who has been nominated by a corporate owner to represent the corporate owner on the body corporate. A person is a corporate owner nominee, for the purpose of voting at a general meeting, if the corporate owner entity gives the secretary a written notice of nomination, stating either:

General meeting motions Motion with alternatives A motion with alternatives is needed when 2 motions propose alternative ways of dealing with the same issue, or 2 quotes are needed for spending. The voting paper for the motion must list each proposal as an alternative under 1 motion submitted by the committee. Procedural motion A procedural motion is a motion about the conduct of a general meeting. A procedural motion does not need to be included on the agenda. An example of a procedural motion is a motion to reverse a decision of the chairperson to rule a motion out of order. Other motions which do not need to be included on the general meeting agenda include:

Statutory motions A statutory motion at an annual general meeting, means a motion to:

Initial contract date For an engagement or authorisation of a service contractor or letting agent, the initial contract date is the earlier of either:

Quorum A quorum is the minimum number of members required to be at a valid meeting. Committee meetings A quorum at a committee meeting is at least half the number of voting members of the committee. For example, if there are 6 voting members for the committee, a quorum is 3. If there are 7 voting members of the committee, a quorum is 4. When deciding whether there is a quorum, a voting member who is present is counted as 1. If a voting member has the proxy of an absent voting member, and the use of proxies for the meeting is not prohibited, the member is counted as 2. A non-voting member is not counted for deciding whether there is a quorum. General meetings A quorum at a general meeting is at least 25% of the number of voters for the meeting. However, if:

Representative of a lot owner An individual is the representative of the owner of a lot, and entitled to vote for that owner at a general meeting, if the person is either:

A lot owner may revoke the authorisation of their representative in writing to the secretary. Required number for committee The required number of voting members for a committee is:

Transferee The person or entity to which the engagement or authorisation as a service contractor or letting agent is transferred. Transferor The person or entity engaged or authorised as a service contractor or letting agent that transfers the rights under the engagement or authorisation to another person or entity (the transferee). Voter for general meeting A voter for a general meeting of the body corporate is an individual:

FINANCIAL MANAGEMENT* Please Click on "+" sign to expand and "-" sign to collapse the topic.

Budgets and funds/Body corporate budgets

The information on this page is for body corporate schemes registered under the:

Funds A body corporate must have an administrative fund and a sinking fund. Budgets for these funds must be prepared every financial year. The budgets for these funds forecast how much the body corporate expects to spend. How much each owner pays in body corporate levies depends on the budgets that the body corporate sets. Preparing budgets The committee must prepare the budgets for owners to consider at each annual general meeting. A copy of the proposed budgets must be included in the notice of an annual general meeting. A budget can be approved by ordinary resolution. Owners can also propose budgets for annual general meetings or extraordinary general meetings. A proposed budget must be submitted by the owner in the form of a motion. Changing budgets When there is a need to change the budget, an explanatory schedule is sent to owners with the annual general meeting notice. It must include an explanatory note telling all owners that the budget might be adjusted. A body corporate can only adjust a proposed budget at an annual general meeting if:

Budgets cannot be adjusted just because owners think the amounts are too high or too low. If adjusted, a copy of the approved budget must be given to each owner with a copy of the minutes of the meeting. Budget increases The cost of goods and services often increase from year to year. Body corporate levies will normally increase to account for rises in the Consumer Price Index (CPI). All bodies corporate are different so levels of spending (and levies) needed must be decided individually. There is a range of information that can help the body corporate prepare its budget. Owners and the committee can get several quotes for goods or services when deciding how much they need to spend. A body corporate may also choose to obtain a professional sinking fund forecast. Disputing budgets and levies If you (as an owner) believe the proposed budgets and levies are too high, you can vote against any motion to approve the budget. You can also propose a different sinking fund or administrative budget. You can do this by submitting a motion for owners to vote on at the annual general meeting. Even if the annual general meeting decides to approve a budget, you can submit an alternative budget to be considered at an extraordinary general meeting. There are a number of adjudicators’ orders about budgets and whether they are reasonable. For example, Panorama 22 [2001] QBCCMCmr 80 (13 February 2001) discussed the requirements for budgets and says the body corporate is not prevented from making subsequent decisions on their budgets and contributions at an extraordinary general meeting if necessary. You can apply for dispute resolution if you think the budget is unreasonably high. If you apply for dispute resolution, you must explain which budget items you object to and why. You should try all other ways to resolve your dispute before you apply for formal dispute resolution such as proposing alternative budgets that you believe are reasonable and necessary. Spending Putting an item of expenditure in a budget is not authority to spend the money. Spending must be authorised by the body corporate, either at a general meeting or by the committee (within its spending limit). Some expenses can only be paid from the sinking fund (e.g. the replacement of major items like fences or common property carpets). All other expenditure must be paid from the administrative fund. The body corporate cannot transfer money from one fund to the other. Payments from the funds can only be made by written request (like an invoice) or written evidence of payment—(like a receipt). Budgets and funds/Sinking fund

A body corporate must have a sinking fund if is registered under the:

Money paid into the fund A body corporate must have an administrative fund as well as a sinking fund. Money cannot be transferred between the funds. Money paid into the sinking fund includes:

Money spent from the fund Money in the sinking fund can be spent on:

Budgets The body corporate must prepare a sinking fund budgets (and an administrative fund budget) each financial year. The sinking fund budget must:

Planning ahead A body corporate needs to budget for major capital spending for the current financial year and the next 9 years. A body corporate may ask a professional to prepare a sinking fund forecast for it. However a body corporate does not have to get a professional sinking fund forecast. The committee or an owner can estimate the likely spending requirements. This is a matter for each body corporate.. Sinking fund investments The body corporate can invest money from the sinking fund if it’s not needed immediately. This is similar to the way a trustee can invest funds. See section 96(2)(b) of the Body Corporate and Community Management Act 1997(PDF) for more information. It is up to the body corporate to decide how to manage and invest its funds. Budgets and funds/Administrative fund

A body corporate must have an administrative fund if is registered under the:

Money paid into the fund The body corporate must have a sinking fund as well as an administrative fund. Money cannot be transferred from one fund to the other. The regulation modules set out what money must be paid into and out of the sinking fund. Any other money must be paid into and out of the administrative fund. Money that needs to be paid into the administrative fund includes:

Money spent from the fund Money in the administrative fund can be spent on anything that is not required to be paid from the sinking fund, including:

Budgets The body corporate must prepare an administrative fund budget (and a sinking fund budget) each financial year. The administrative fund budget must estimate the necessary and reasonable expenditure for the financial year for:

Administrative fund investments The body corporate may invest money from the fund if it’s not needed immediately. This is similar to the way a trustee can invest funds. See section 96(2)(b) of the Body Corporate and Community Management Act 1997(PDF) for more information. It is up to the body corporate to decide how to manage and invest its funds. Budgets and funds/Promotion fund

A body corporate registered under the Commercial Module can set up a promotion fund. A promotion fund:

Preparing budgets The committee must prepare the budgets for owners to consider at each annual general meeting. A copy of the proposed budgets must be included in the notice of an annual general meeting. Owners can also propose budgets to be considered at an annual general meeting or an extraordinary general meeting. A proposed budget must be submitted as a motion. Changing budgets A promotion fund budget can only be amended at another general meeting. Owners cannot adjust the proposed promotion fund budget at the same general meeting (this can only be done for sinking fund or administrative fund budgets). Owners can be asked to pay a special levy if the body corporate wants more money for the promotion fund. Investing promotion funds The body corporate may invest money from the fund if it’s not needed immediately. This is similar to the way a trustee can invest funds. See section 96(2)(b) of the Body Corporate and Community Management Act 1997 (QLD) (PDF). It is up to the body corporate to decide how to manage and invest its funds. Authority to spend/Committee spending

The following information is for community titles schemes registered under the:

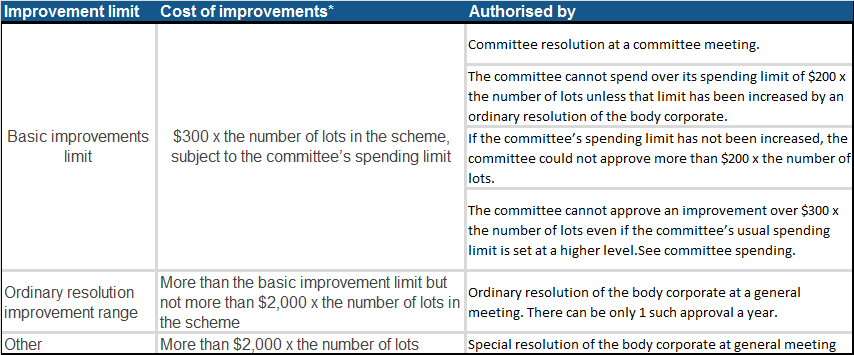

Spending limits The relevant limit for committee spending (how much money a committee can spend) can be set by ordinary resolution of the body corporate (i.e. a motion voted on by the owners at a general meeting). There is no minimum or maximum limit that the body corporate can set. If no amount is set by a general meeting resolution the relevant limit is calculated by multiplying the number of lots in the scheme by $200. For example, in a body corporate with 6 lots, the relevant limit is $1,200 ($200 x 6). GST included The committee must allow for any goods and services tax (GST) in its spending. For example, the committee spending limit for a scheme made up of 12 lots is $2,400 (12 x $200). The committee has a quote for maintenance of $2,300 plus GST. The total amount, including the GST is $2,530. This is more than the committee’s spending limit of $2,400. The committee would need approval by ordinary resolution at a general meeting to accept this quote. Committee spending limits in a layered scheme The relevant limit for committee spending in a layered scheme can be set by ordinary resolution of the body corporate. There is no minimum or maximum spending limit that can be set. If no amount is set, the relevant limit is calculated by multiplying the number of layered lots in the scheme by $200. For example, the principal body corporate consists of 5 lots and common property. Four of the 5 lots are also community titles schemes with 20 lots each. These lots are referred to as the layered lots. In this example the relevant limit for committee spending for the principal body corporate is $16,200. The figure is calculated as: (1 + 20 + 20 + 20 + 20 ) x $200 = 81 lots x $200 = $16,200. Available funds Before the committee approves any spending within its limit it will need to be sure there is enough money in the budget for the specific expense. The committee can call a general meeting to amend the budget or raise a special levy if no money or not enough money is available. Spending in stages The committee cannot divide a single project into smaller parts in order to bring the project within its spending limit. For example, the committee for a scheme made up of 25 lots is limited to spending $5,000 (25 x $200). The committee wants to renovate the main foyer and has obtained quotes. The costs are:

The committee would need approval by ordinary resolution at a general meeting. Spending over the committee spending limit The committee can only spend over its relevant limit if:

Quotes for spending The number of quotes that a committee needs to consider when making decisions is determined by the relevant limit for major spending. The body corporate may set the relevant limit for committee spending higher than the relevant limit for major spending by the scheme. The committee must have at least 2 quotes for any spending that is more than the relevant limit for major spending by the scheme. For example, if the committee spending limit is $12,000 and the major spending limit is $10,000, any spending over $10,000 but under $12,000 can be approved by the committee if it gets and considers at least 2 quotes. The body corporate can obtain extra quotes even if the legislation does not require it. Spending that is not permitted The committee cannot spend more than its relevant limit for spending. It can only spend on items provided for in the budget. If there is no provision in the budget for the expense, the committee cannot authorise the spending even if the amount is within its spending limit. A committee cannot spend on items that can only be approved by a general meeting resolution. A committee should not spend funds above the level approved by the body corporate. Improvements to common property A body corporate committee can organise improvements to the common property. The authority of the committee is again set by spending limits. Detailed information on improvements to the common property by the body corporate and the improvement limits is outlined on our improving common property and lots webpage. Other regulation modules Schemes registered under the Commercial Module must elect a committee but the committee does not have a spending limit. Committees in those schemes can spend as much as needed. Spending must be authorised at either a committee meeting or by voting outside a committee meeting. Schemes registered under the Specified Two-lot Schemes Module do not need a committee. Authority to spend/Body corporate spending

Information on this page is for community titles schemes registered under the:

Schemes registered under the Specified Two-Lot Schemes Module and the Commercial Module do not have spending limits. Major spending limit The limit for major spending is only used to determine how many quotes are required when considering a motion at either a committee meeting or a general meeting. The body corporate can set the major spending limit by ordinary resolution at a general meeting. There is no minimum or maximum amount that can be set. If no amount is set, the limit is the lesser of either:

For example, the limit for a body corporate with 5 lots would be $5,500 ($1,100 x 5 lots), as this amount is less than $10,000. In a 15 lot scheme the limit would be $10,000, because it is less than $16,500 ($1,100 x 15 lots). Note: it does not prevent the body corporate or the committee from spending more than the major spending limit—it just requires 2 quotes to be considered. GST included The body corporate must allow for goods and services tax (GST) when it is spending. For example, the major spending limit for a scheme of 12 lots is $10,000 (as no alternative amount has been set by ordinary resolution). A quote is obtained for maintenance of the building's roof. The cost is $10,000 plus GST. The entire amount, including GST will be spent from the body corporate funds and must be considered as part of the spending. This proposal would be above the major spending limit because the amount being spent is $11,000. Two quotes must be obtained. Major spending limits in a layered scheme The relevant limit for major spending in a layered scheme can be set by ordinary resolution of the body corporate. There is no minimum or maximum spending limit that can be set. If no amount is set, the relevant limit is the lesser of either:

If no amount was set by ordinary resolution, the calculation would look like this: Number of layered lots (1 + 20 + 20 + 20 + 20) x $1,100 = 81 x $1,100 = $89,100. As this total amount is more than $10,000, the relevant limit for major spending for the principal body corporate in this layered scheme is $10,000. Available funds When deciding to approve spending, the body corporate should consider if it has sufficient money available and allocated in the budget. The body corporate can consider a motion to amend the budget or raise a special levy if not enough money is available. Spending in stages The body corporate cannot break down a single project into smaller parts in order to bring it within the major spending limit. If a single project is more than the relevant limit, the cost of any 1 of the parts is taken to be more than the relevant limit for major spending for the scheme. For example, the major spending limit for a body corporate is $10,000. The body corporate is considering painting the building. One quote is obtained. The breakdown of costs is:

The project is ‘painting the building’. The quoted cost of this project of $17,900 is above the major spending limit and 2 quotations would be needed. Spending over the major spending limit If a proposal for spending is to be considered at a general meeting and the amount is more than the major spending limit for the scheme:

Exception for 2 quote rule One quote may be enough in exceptional circumstances where it's not possible to get 2 quotes. For example, if the body corporate wants to buy something that can only be obtained from a single source that would be considered an exceptional reason for not obtaining 2 quotations. Improvements to common property A body corporate may approve improvements to the common property by ordinary resolution if the improvements are within the ordinary resolution improvement range for the scheme (but only one such motion can be approved in each financial year) all subsequent motions in that financial year must be approved by special resolution. Detailed information on improvements to common property by the body corporate and the improvements limit is outlined in our improving common property and lots webpage. Spending approvals See a guide to spending at general meetings for help working out how spending is authorised. Lot entitlements/About lot entitlements

This information is relevant to all schemes in Queensland registered under the Body Corporate and Community Management Act 1997 and any of the 5 regulation modules. Lot entitlements in community titles schemes set out each owner’s:

Lot entitlement schedules for your community titles scheme are recorded in a document called the community management statement. Get a copy of your community management statement. Lot entitlement schedules There are 2 lot entitlement schedules. They are the:

For each of the 2 schedules, each lot (or unit) in the scheme is identified and given a whole number. The aggregate or total of all of the lot entitlements is also shown—for the contribution schedule the aggregate is 8 lot entitlements. For the interest schedule it is 16. Schemes before 13 July 1997 The registered plans for schemes created before 13 July 1997, have only 1 schedule of lot entitlements. For these schemes, the law says that the contribution schedule lot entitlements and interest schedule lot entitlements are identical to the single schedule endorsed in the original plan. See the Body Corporate and Community Management Act 1997 (PDF) (QLD) —transitional provisions for more information. How lot entitlements are used Contribution schedule The contribution schedule lot entitlements are used to calculate:

Interest schedule The interest schedule lot entitlements are used to calculate:

Costs for services supplied to a lot (e.g. water and electricity) that can be separately measured and charged are not divided among the owners on the basis of lot entitlements. The owners are separately billed by the service provider for the cost of supplying the service to their lot. Lot entitlements/Setting lot entitlements

This information is relevant to all schemes in Queensland registered under theBody Corporate and Community Management Act 1997 and any of the 5 regulation modules. Lot entitlements are set by the original owner (the developer) when a community titles scheme is established. Lot entitlement schedules The community management statement for community titles schemes in Queensland has 2 lot entitlement schedules. They are the:

From 2011 original owners were required to set lot entitlements according to certain principles. Contribution schedule principles The principles for deciding contribution schedule lot entitlements are:

The equality principle Lot entitlements must be equal under the equality principle (except to the extent that it is just and equitable for them not to be equal). For example, if there is a commercial community titles scheme where the owner of 1 lot uses more water or runs a more dangerous or higher risk activity than the other lot owners it may be just and equitable for that lot to have a higher contribution schedule lot entitlement. The relativity principle Under the relativity principle, lot entitlements must consider the relationship between the lots according to a number of factors. Factors include:

The interest schedule principle The principle for deciding interest schedule lot entitlements is the market value principle except to the extent that it is just and equitable not to reflect the market value. The community management statement must say whether the market value principle applies and if not, explain why. If you want to find out more about market values you may want to speak to a property valuer or a real estate agent. Schemes after 14 April 2011 Contribution schedule For any scheme established on or after 14 April 2011, or an adjusted scheme, the community management statement must show the deciding principle for the contribution schedule.

An adjusted scheme is a scheme that was established before 14 April 2011 but that has since adjusted the contribution schedule or interest schedule. Interest schedule For the interest schedule, the community management statement must say whether the market value principle applies and if not, explain why. Schemes from 13 July 1997 to 2011 Before 2011, contribution schedule lot entitlements were set on the basis that entitlements must be equal (except to the extent that it is just and equitable for them not to be equal). These lot entitlements will continue to apply unless an adjustment is made to 1 or both of the schedules. Schemes before 13 July 1997 The registered plans for schemes created before 13 July 1997, have only 1 schedule of lot entitlements. For these schemes, the law says that the contribution schedule lot entitlements and interest schedule lot entitlements are identical to the single schedule endorsed in the original plan. Lot entitlements/Applying lot entitlements

This information is relevant to all schemes in Queensland registered under the Body Corporate and Community Management Act 1997 (the Act) and any of the 5 regulation modules. The community management statement for each community titles scheme in Queensland has 2 schedules of lot entitlements. They are the:

Lot entitlements decide many issues including an owner’s share in body corporate costs. This page gives you some examples of how lot entitlements would be applied when deciding body corporate spending and voting. Owner contributions At its annual general meeting a body corporate approves an administrative fund budget for expected expenses. They may include (but are not limited to):

If, for example, you have 3 contribution schedule lot entitlements and the total contribution schedule lot entitlements for the scheme is 30, you will contribute 3/30 or 10% of these costs. The expenses are divided equally among the owners only if the contribution schedule lot entitlements for each lot in the scheme is equal. A body corporate cannot decide to equally share body corporate costs when the contribution schedule lot entitlements are not equal. The scheme’s lot entitlements would have to be adjusted before owners would pay equal contributions. Insurance If a body corporate is required under the Act to take out building insurance, the premium may not be divided according to the contribution schedule lot entitlements of each lot. This is because insurance is treated differently from most other body corporate expenses. How building insurance costs are divided depends on the type of plan of subdivision that applies to the scheme.

Voting when a poll has been requested Usually when voting on a motion that can be decided by ordinary resolution, each lot in the scheme has 1 vote. However, the Act allows owners to request a poll vote. A poll is another way of counting votes. It takes into account the contribution schedule lot entitlements for the scheme. There are strict laws around requesting a poll vote and counting votes for a poll. Lot entitlements/Adjusting lot entitlements

The community management statement for community titles scheme in Queensland has 2 lot entitlement schedules. They are the:

Adjusting the contribution schedule This information is relevant to community titles schemes registered under all 5 regulation modules. There are 3 ways to adjust the contribution schedule lot entitlements:

General meeting A body corporate can change its contribution schedule lot entitlements by ‘resolution without dissent’, at a general meeting. The notice of general meeting where the motion is proposed must explain the proposed change and the reasons for it. The changes must be consistent with either the principle on which the existing contribution schedule was decided or another contribution schedule principle. The body corporate must, within 3 months, put in a request to record a new community management statement including the changed contribution schedule lot entitlements. The community management statement is the document that records the lot entitlement schedules for your community titles scheme. See section 47A of the Body Corporate and Community Management Act 1997(PDF) (the BCCM Act). For schemes registered under the Specified Two-lot Schemes Module there is no need to call general meetings as all decisions are made by lot owner agreement. The same information applies as given above with the exception of calling and holding a meeting. All the remainder of the information must be relayed in a lot owner agreement and if both owners agree, the body corporate can lodge the request to record a new community management statement. Agreement of lot owners The owners of 2 or more lots can agree in writing to redistribute their lot entitlements among themselves. The owners of the 2 lots must:

Decision of specialist adjudicator or QCAT As a lot owner you may apply for an adjustment of the contribution schedule lot entitlements. However, the reasons are limited. They are:

How decisions are made In deciding whether the contribution schedule follows the principle used to set it, a specialist adjudicator or the QCAT consider:

See section 48A of the BCCM Act. Adjusting the interest schedule As a lot owner you can apply to a specialist adjudicator or the QCAT for an order to adjust the interest schedule lot entitlements. The order of the specialist adjudicator or Queensland Civil and Administration Tribunal must be consistent with the market value principle. Lot entitlements/Changes to lot entitlements laws

This information is relevant to all schemes in Queensland registered under the Body Corporate and Community Management Act 1997 (the Act) before 2013. Lot entitlements allocate each owner’s share of common property and assets, and their rights and expenses in the body corporate. Generally, community titles schemes in Queensland have 2 lot entitlement schedules. They are the:

Laws before 2013 Before 2011, the Act allowed lot owners to apply for an order to change their lot entitlements. If orders were made, these are known as ‘adjustment orders’. In 2011 the Act was changed. Community titles schemes were allowed to change their contribution schedule lot entitlements back to the schedule that was in place before any adjustment orders. This could be done if a lot owner submitted a motion to the body corporate requesting the change. This is known as the ‘2011 reversion process’. The 2011 changes also affected how those disputes were resolved. The 2011 reversion process is explained in more detail below. Changes in 2013 Under the 2013 changes to the Act, bodies corporate no longer had to do the 2011 reversion process. They could also stop any current adjustment orders—those started on or after 14 September 2012. As a result of the changes, any unfinished matters or proceedings relating to a 2011 reversion process no longer applied. See sections 397, 399, 400 and Schedule 5A of the Act (PDF) for more information. The 2013 changes also:

These changes started on 27 March 2013. Any incomplete matters or proceedings relating to a 2011 reversion process ceased to have effect when the changes started—see, sections 397, 399, 400 and Schedule 5A of the Act. Dispute resolution Under the most recent changes in 2013, if a body corporate passes a resolution without dissent to change the contribution schedule lot entitlements, a lot owner who believes the changed entitlements are not in keeping with the relevant principle used can apply to:

For more information see:

Adjudicators cannot determine an application

The 2013 amendments also added requirements for:

Effect of the changes A body corporate no longer has to undertake a 2011 reversion process. Any incomplete matters or proceedings about a 2011 reversion process will cease to have effect. Bodies corporate can register a new community management statement in accordance with an adjustment order (referred to as a relevant decision) which was not able to be registered because of the 2011 amendments. Bodies corporate and committees can reinstate the contribution schedule lot entitlements to the last adjustment order entitlements. For more information see the Act sections:

Lot owner disputes A lot owner can dispute the changed lot entitlements determined by the committee or body corporate under these processes if they believe the changes do not correctly reflect the decided entitlements or last adjustment order entitlements. The owner may apply for an order of a specialist adjudicator or the Queensland Civil and Administrative Tribunal. See the Act:

Recording changesUnder the 2013 amendments, it is an offence if a body corporate does not:

Accounts, audits and contributions/Body corporate accounts

The requirement for your body corporate to have an account and how it should be managed depends on which regulation module applies to your scheme. This information relates to the following regulation modules:

The financial institution account A body corporate must have 1 or more bank accounts kept in its name. The account must be at a financial institution such as a bank, building society or credit union. An account opened after 4 March 2003 must only be opened with the consent of the body corporate. This account can be run by:

Body corporate manager A body corporate manager can be authorised to operate a body corporate's bank account. A body corporate manager cannot make decisions on what and when money is spent from the account and must ensure proper decisions are made before spending either by the:

The financial institution must not let the body corporate manager operate the account after this notice has been given. Statement of accounts The body corporate must keep proper accounting records and prepare them for each financial year. The statement of accounts must:

Cash or accrual The following information is relevant only to schemes registered under either the:

If the accounts are prepared on a cash basis, they must include information about:

The statement of accounts must include:

Administrative and sinking funds There are rules on how to manage the administrative and sinking funds. These include:

Borrowing money A body corporate can borrow money-the rules are different for each regulation module, including:

Standard Module A decision to borrow money can be decided by ordinary resolution at a general meeting unless the amount to be borrowed is more than $250 multiplied by the number of lots in the scheme. If it is more, a resolution without dissent is needed. Accommodation Module and Commercial Module A decision to borrow money can be decided by ordinary resolution at a general meeting unless the amount to be borrowed is more than $250 multiplied by the number of lots in the scheme. If it is more,a special resolution is needed. Small Schemes Module A decision to borrow money can be decided by ordinary resolution at a general meeting unless the amount to be borrowed is more than $3000 (in total). If it is more, a resolution without dissent is needed. Accounts, audits and contributions/Financial reporting

The following information is relevant to schemes registered under the:

Reporting to the committee A body corporate can engage a body corporate manager that is authorised to operate the bank account. A body corporate manager who pays an bill that has been approved by the committee must (if asked) give the committee a written report on the payment. This does not apply if the body corporate manager is engaged in place of the committee (under chapter 3, part 5 of the standard and accommodation modules). Only under a Standard Module must a committee member give a written report (if asked) when they are acting on a committee decision and the spending is:

Reconciliation statements A body corporate manager must prepare a reconciliation statement if they administer the body corporate’s administrative fund and sinking fund. Under the Commercial Module the body corporate manager must also prepare a reconciliation statement for the promotion fund (if there is one). The reconciliation statement must be prepared within 21 days from the last day of each month. The statement is for each account kept for the funds. The statement must reconcile (or match up):

When a manager’s contract ends A body corporate manager, who administers the administrative and sinking funds (or promotion funds for schemes under the Commercial Module), must give financial records to the body corporate when their contract ends (i.e. the termination date of their contract). The records they must provide for each fund they administer are:

Time limits The manager has up to 30 days after their contract ends to give the body corporate these financial records. However, during those 30 days, the committee can give notice to the manager asking for return of all body corporate’s records and property. If a notice is given, the body corporate manager has 14 days to return all the records and property. Read more about returning records. Accounts, audits and contributions/Auditing body corporate accounts

The following information is relevant to schemes registered under the:

Schemes registered under the Specified Two-lot Schemes Module do not require a bank account and therefore do not need an audit. Statement of accounts A statement of accounts shows the body corporate’s income and spending for the year. At its annual general meeting each year, the body corporate must about auditing the accounts. Owners vote to decide if the the accounts are audited or not. Motion not to audit The body corporate can pass a motion at its annual general meeting not to audit its accounts. The motion is passed by special resolution. The motion not to audit must:

If a motion not to audit the accounts is not passed, the body corporate must have its accounts audited. It will need to pass a motion to appoint an auditor, which must be passed by ordinary resolution. Audit at other times If the body corporate decides at the annual general meeting not to audit its statement of accounts for a particular financial year, at any time it can:

Auditor A body corporate must also include on each annual general meeting agenda a motion to appoint an auditor. This normally sits below the motion 'not to audit' the accounts. The motion for the body corporate to appoint an auditor is not voted on if the body corporate has already passed the motion not to have their accounts audited. The motion appointing the auditor must include the name of the auditor. The motion must pass by ordinary resolution. The auditor must provide a certificate reporting on the accounts. A copy of the certificate must be included with the notice of the next annual general meeting to be held after the certificate is received by the body corporate. Qualifications and experience of auditorThe auditor who is appointed by ordinary resolution of the body corporate must:

Small and two-lot schemes Different rules apply for bodies corporate registered under the Small Schemes Module and the Specified Two-lot Schemes Module. Small schemes can decide to audit their accounts, but it is not compulsory for a motion about the audit to be on the agenda of the annual general meeting. Specified Two-lot schemes do not have a bank account and do not need to have an audit. Accounts, audits and contributions/Owner's contributions

Each lot owner must pay a share of body corporate expenses (i.e. owner contributions). Bodies corporate budget for expenses and then levy each owner in the scheme for the money they need to meet those expenses. The following information is relevant to schemes registered under the:

How contributions are decided The annual levies that lot owners must pay each year are decided at each annual general meeting. At that meeting the body corporate must, by ordinary resolution:

Special contribution Additional levies, known as a special contribution, must be collected by the body corporate if it has to pay for unexpected costs during the financial year. These can be costs that were either not included in the budget or not enough money was set aside to meet them. For example, if the cost of painting common property is more than the amount allocated in the sinking fund budget for the work, the body corporate can decide to collect a special contribution from owners to meet the extra cost. To agree to collect a special contribution, the body corporate must pass an ordinary resolution. Interim contribution The committee may fix an interim contribution for either the administrative or sinking fund levies. An interim contribution helps the body corporate meet a shortfall in monies until new levies are set or received from 1 financial year to the next. Interim contributions are calculated on the basis of contributions that were set for the previous financial year. If an interim contribution is levied it must be offset against the relevant budget as decided at next general meeting. Calculating levies The contributions levied on the owner of each lot must be based on the contribution schedule lot entitlements, unless the legislation says otherwise. The contribution schedule lot entitlements are listed in the community management statement recorded for the scheme. One exception is building insurance. Insurance payments for owners in a building format plan are based on the interest schedule lot entitlements, not the contribution schedule lot entitlements. Contribution notice The body corporate must give each owner written notice of the contributions they owe. This notice must be given at least 30 days before a contribution is due. The contribution notice must include:

Discounts and penalties The body corporate can use discounts and late payment penalties to encourage owners to pay contributions by the due date. The body corporate must decide by ordinary resolution to give discounts and charge penalties. A discount may be given to an owner if their contribution is paid to the body corporate by the due date. The discount cannot be more than 20% of the instalment amount. An owner can be charged a penalty if their contribution is not paid to the body corporate by the due date. The penalty will be simple interest at a set rate (not more than 2.5%) for each month that the contributions are overdue. Even if a payment is late, the body corporate can decide to allow the discount or not charge the penalty, in full or in part, if there are special reasons. Unpaid contributions If a contribution is not paid by the due date, the body corporate can start debt recovery action to recover the amount. If a debt has been overdue for 2 years, the body corporate must start debt recovery within 2 months of that date. This does not stop the body corporate from starting debt recovery earlier. Debt recovery The body corporate can lodge a debt dispute claim with:

Conciliation The body corporate or an owner can apply for conciliation through the Office of the Commissioner for Body Corporate and Community Management to determine a dispute about a debt. However, if debt recovery action has been started in the QCAT or a court, the dispute cannot be conciliated. If debt recovery action is started after a conciliation application is lodged, the conciliation application must end. Accounts, audits and contributions/Owner's contributions for two-lot schemes

This information is for schemes registered under the Specified Two-lot Schemes Module. Even if you only have 2 units in your scheme, you may not be registered under this module. The regulation module applying to your scheme will be listed on your community management statement. Agreed body corporate expenses Each lot owner must pay a share of body corporate expenses (called owner contributions). An agreed body corporate expense is an amount that the 2 owners that make up the body corporate have decided to pay, by a lot owner agreement. Some costs will automatically be agreed body corporate expenses. This includes costs the body corporate must meet to comply with:

Contributions Each lot owner must contribute to an agreed body corporate expense. The contributions are calculated on the contribution schedule lot entitlement of the lot, except if the contributions are for insurance expenses. For example, if the contribution lot entitlements for each lot are equal, each lot owner will contribute the same amount towards each agreed body corporate expense. Contributions must be paid by the due date set in the lot owner agreement, or when required by the relevant order. If no date has been fixed, the contribution must be paid on or before the date stated in the contribution notice for an agreed body corporate expense. Contribution notice If the body corporate or a lot owner gets a notice of an agreed body corporate expense, the lot owner can give the other lot owner a contribution notice. The contribution notice must say:

For example, if an owner gets notice of the cost to renew the body corporate’s insurance, the owner must give the other owner a contribution notice as soon as possible setting out the total cost of the renewal, the amount each owner owes, and the due date. Unpaid contributions If an owner does not pay their share of an agreement there are steps the other owner can take. Section 27 of the Specified Two-lot Scheme Module (PDF) refers to the ‘defaulting owner’ and the ‘contributing owner’. A defaulting owner is an owner who does not pay their contribution by the due date. A contributing owner is an owner who pays their contribution by the due date. A contributing owner can choose to pay the defaulting owner’s contribution. If they do, the contributing owner can then get that amount back from the defaulting owner as a debt. The contributing owner can also recover any penalty for late payment and any reasonable costs that may have resulted. The body corporate can recover the overdue amount from the defaulting owner as a debt. The contributing owner can start proceedings on behalf of the body corporate to recover the overdue contribution. Any penalty for late payment and any reasonable costs that may have resulted can also be recovered. Debt recovery The body corporate or the contributing owner can lodge a debt dispute claim with:

Conciliation The body corporate or the contributing owner can apply for conciliation with us to determine a dispute about a debt. However, if debt recovery action has been started in the Queensland Civil and Administrative Tribunal or a court, the dispute cannot be dealt with in conciliation. If debt recovery action is started after a conciliation application is lodged, the conciliation application must end. MEETINGS* Please Click on "+" sign to expand and "-" sign to collapse the topic.

Annual general meetings/Holding an annual general meeting

At an annual general meeting, your body corporate will decide matters such as:

The annual general meeting must take place:

The secretary must send a letter to all lot owners 3 to 6 weeks before the end of the body corporate’s financial year, inviting lot owners to submit motions for the annual general meeting and asking for committee nominations. The financial year The financial year for a body corporate is not always the same as the tax year (1 July to 30 June). The financial year for your body corporate is determined by either the year the body corporate was set up or by the date of the first annual general meeting. Schemes established before 1997 Before the start of the Body Corporate and Community Management Act 1997(PDF) (BCCM Act), the Building Units and Group Titles Act 1980 (PDF) (BUGTA) applied. Building unit plans and group title plans established under BUGTA are called ‘existing plans’. For an existing plan, the financial year ends on the last day of the month in which the first annual general meeting was held (e.g. if the first annual general meeting was held on 10 May 1993, the financial year will be 1 June to 31 May). An adjudicator may make an order under the dispute resolution provisions changing the financial year end date, usually if requested by a general meeting resolution. Schemes established after 1997 For schemes established under the BCCM Act, the financial year ends on the last day of the month, immediately before the month when the community titles scheme was established (e.g. if the scheme was established on 10 May 1998, the last day of the financial year is 30 April. The financial year will be 1 May to 30 April). An adjudicator may make an order under the dispute resolution provisions changing the financial year end date, usually if requested by a general meeting resolution. First annual general meeting The original owner (the developer) must hold the first annual general meeting. The meeting must be called and held within 2 months after either:

The agenda at the first annual general meeting must include specific motions.Refer to section 77(3) of the Standard Module (PDF). There are corresponding sections in all other regulation modules except the Specified Two-lot Schemes Module. The original owner must hand over certain documents to the body corporate at the first annual general meeting. Section 79 of the Standard Module(PDF) provides details. There are corresponding sections in all other regulations modules except the Specified Two-lot Schemes Module. Annual general meetings/Calling an annual general meeting

Who can call an annual general meeting The following people can call the annual general meeting:

Giving lot owners notice Each lot owner must be given a written notice of the annual general meeting. It is the secretary’s job to send the notice taking into account information about who is authorised to call the meeting. The notice must be given to the lot owner personally or sent to the address for service for the lot. The notice must include:

Agenda The agenda must include:

Voting papers The secretary must prepare 1 voting paper for all open motions to be decided at the annual general meeting. The secretary must also prepare a secret voting paper for any motion to be decided at the meeting by secret ballot. If there are 2 or more motions that need a secret ballot, they can appear on the same secret voting paper. A voting paper must:

Explanatory schedule The explanatory schedule is part of the notice of an annual general meeting. It includes material about motions on the agenda such as:

The committee is not subject to a word limit when including an explanatory note. Annual general meetings/Running an annual general meeting

Chairing the annual general meeting The chairperson must chair all of the annual general meetings that they attend. If there is no chairperson or the chairperson is not at the meeting, people at the meeting who have a right to vote can choose another person to chair the meeting. The body corporate manager can advise and help the chairperson. They can only chair the meeting if they are chosen by those people at the meeting who have a right to vote, or if they are the only person forming a quorum at the meeting (see Quorum at general meetings). Duties and powers of the person chairing the meeting include:

Ruling motions out of order A motion must be ruled out of order if:

When declaring the result of voting on motions at the annual general meeting, the person chairing the meeting must state the votes for, against and abstentions on the motion. When declaring the result of an election for a committee position, the person chairing the meeting must state the number of votes cast for each candidate. Amending motions A motion can be amended at a general meeting by the people present and who have a right to vote. A motion to amend a motion is a procedural motion. Any motion once amended is referred to as the amended motion. When counting the votes for and against a motion to amend and an amended motion: